Microeconomics: When Markets Fail (Coursera)

Categories

Effort

Languages

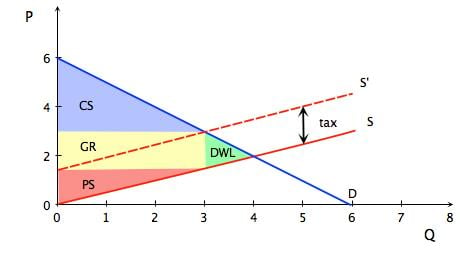

Perfect markets achieve efficiency: maximizing total surplus generated. But real markets are imperfect. In this course we will explore a set of market imperfections to understand why they fail and to explore possible remedies including as antitrust policy, regulation, government intervention. Examples are taken from everyday life, from goods [...]

Apr 30th 2024