MOOC List is learner-supported. When you buy through links on our site, we may earn an affiliate commission.

MOOC List is learner-supported. When you buy through links on our site, we may earn an affiliate commission.

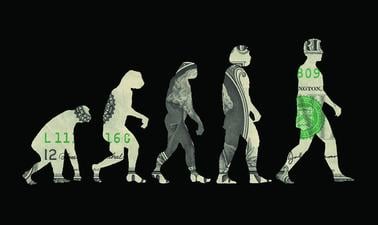

This is one of the biggest debates in economics, and the value or futility of investment management and financial regulation hang on the outcome. In this course, MIT finance professor Andrew W. Lo cuts through this debate with a new framework—the Adaptive Markets Hypothesis—in which rationality and irrationality coexist.

Drawing on psychology, evolutionary biology, neuroscience, artificial intelligence, and other fields, this course shows that the theory of market efficiency isn’t wrong, but merely incomplete. When markets are unstable, investors react instinctively, creating inefficiencies for others to exploit. This new paradigm explains how evolution shapes behavior and markets at the speed of thought—a fact revealed by swings between stability and crisis, profit and loss, and innovation and regulation.

A fascinating intellectual journey filled with compelling stories, the course begins with the origins of market efficiency and its failures, turns to the foundations of investor behavior, and concludes with some practical implications—including how hedge funds have become the Galápagos Islands of finance, what really happened in the 2008 meltdown, and how we might avoid future crises.

This course provides ambitious new approaches to address some of the biggest challenges facing us today such as cancer, climate change, the energy crisis, and how to navigate through the choppy waters of global financial markets in a post-COVID-19 world.

What you'll learn

- Limits to rationality and market efficiency, and the adaptive nature of markets

- Psychlogical, neuroscientific, and evolutionary foundations of human behavior

- Formulation of the Adaptive Markets Hypothesis (AMH)

- Applications of the AMH to hedge funds, the 2008 Financial Crisis, and COVID-19

- Ethical implications and high-impact applications of the AMH

Syllabus

Unit 1: Introduction and Financial Orthodoxy

Unit 2: Rejecting the Random Walk and Efficient Markets

Unit 3: Behavioral Biases and Psychology

Unit 4: The Neuroscience of Decision-Making

Unit 5: Evolution and the Origin of Behavior

Unit 6: The Adaptive Markets Hypothesis

Unit: 7: Hedge Funds: The Galapagos Islands of Finance

Unit 8: Applications of Adaptive Markets

Unit 9: The Financial Crisis

Unit 10: Ethics and Adaptive Markets

Unit 11: The Finance of the Future and the Future of Finance

MOOC List is learner-supported. When you buy through links on our site, we may earn an affiliate commission.

MOOC List is learner-supported. When you buy through links on our site, we may earn an affiliate commission.